Payroll expense calculator

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. The Off-Payroll IR35 legislation is a reform to IR35 that was introduced in the public.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

. Use this calculator to assess the impact that the Off-Payroll IR35 legislation has on your net income. In that instance you would calculate gross pay like this. Ad Our Resources Can Help You Decide Between Taxable Vs.

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Enter your info to see your take home pay. Ad Compare This Years Top 5 Free Payroll Software. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

Get Started With ADP Payroll. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. Ad Process Payroll Faster Easier With ADP Payroll.

All inclusive payroll processing services for small businesses. How do you calculate the payroll tax expense. Taxes Paid Filed - 100 Guarantee.

Get a free quote today. Seller closing costs can range from 8 to 10 of the home. Time spent supporting payroll production eg.

To determine each employees FICA tax liability multiply their gross wages by 765 as seen below. That equates to between 5000 and 12500 on a 250000 mortgage and comes on top of the down payment you make. Payroll expenses are the costs associated with hiring employees and independent contractors for your business.

To pay workers start with gross pay and. 40 hours worked x. Free Unbiased Reviews Top Picks.

The standard FUTA tax rate is 6 so your max. Lets say that same employee worked 45 hours the following week. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Ad Submit Expenses from Anywhere with the 1 Cloud Based Suite. Employees cost a lot more than their salary. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Subtract 12900 for Married otherwise. Salary Paycheck and Payroll Calculator.

Ad Process Payroll Faster Easier With ADP Payroll. Calculating paychecks and need some help. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Approving timesheets leave applications. Add Box 1 plus Box 2 plus Box 3 plus Box 4 and enter the Total payroll costs in Box 5.

Rules for calculating payroll taxes. Step 6 Calculate the average monthly payroll cost. It will confirm the deductions you include on your.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Anualised cost of payroll staff including super payroll tax kiwisaver etc. Plans Pricing How it Works.

Heres a step-by-step guide to walk you through. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. These are the amounts you.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Learn How Heartland is Powering Americas Small Business Renaissance. October 18 2020.

2020 Federal income tax withholding calculation. All other pay frequency inputs are assumed to. Get Started With ADP Payroll.

Plug in the amount of money youd like to take home. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Ad Accurate Payroll With Personalized Customer Service.

Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up. 40 hours worked x 14 per hour 560. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your.

Get a free quote today. Compute total annual payroll costs.

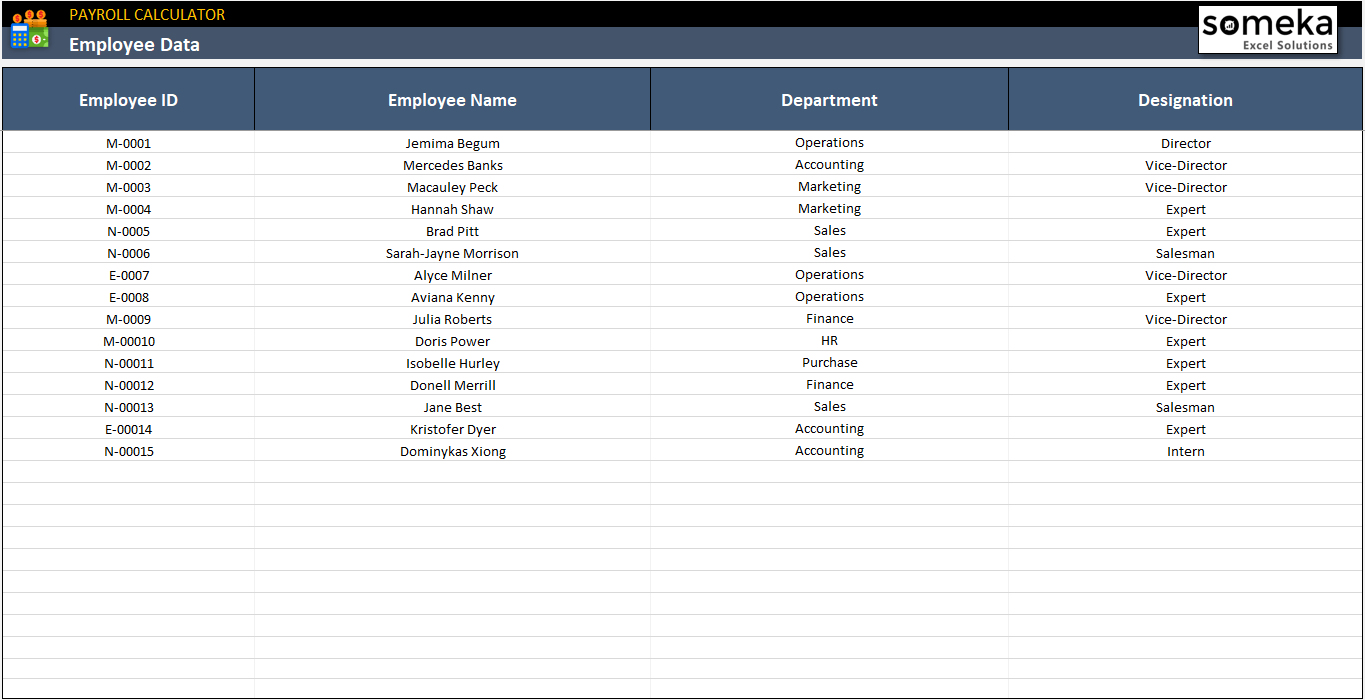

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator Free Employee Payroll Template For Excel

How To Do Payroll In Excel In 7 Steps Free Template

How To Calculate Payroll Taxes Methods Examples More

Payroll Calculator With Pay Stubs For Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Calculator With Pay Stubs For Excel

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Formula Step By Step Calculation With Examples

Payroll Tax Calculator For Employers Gusto

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Paycheck Calculator Take Home Pay Calculator

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Calculator With Pay Stubs For Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel